How ZIFTM could be a boon to the Banking and Financial Services Industry

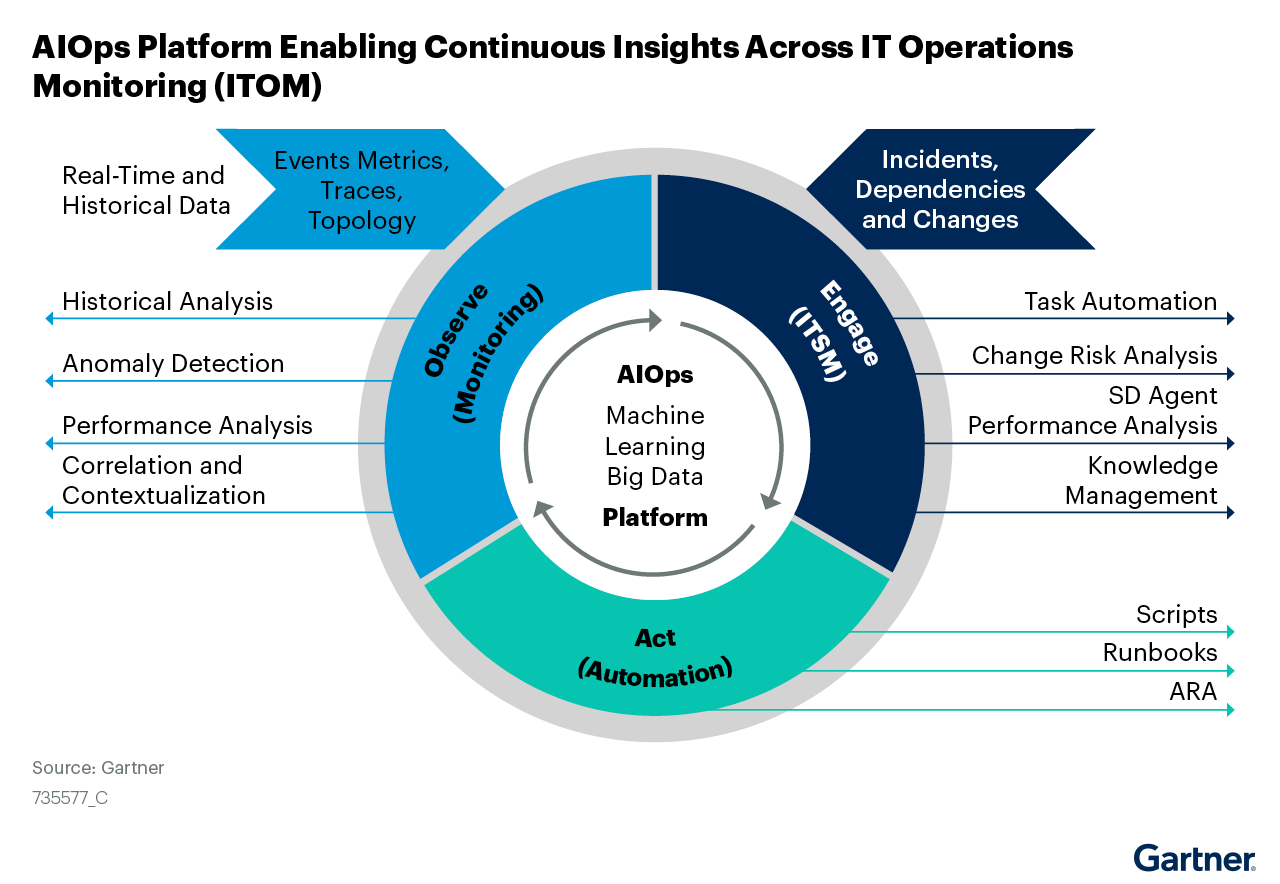

The enhancement of the IT operations by the application of Artificial Intelligence and Machine Learning Analytics is called as AIOps. This was a term that was coined by Gartner in 2016. As most firms have moved from the traditional static physical systems to a more dynamic mix of on-premises and cloud environments, the amount of data that is getting generated is humongous. The traditional IT management systems are overwhelmed by these huge amounts of data. Hence, organizations across industries have started adopting AIOps in their Digital Transformation journey.

However, the banking and payment industry has lagged in adopting AIOps. As per a report “siloed data sets, regulatory compliance, fear of failure, and unclear internal ownership of emerging technologies” are some of the reasons for the hesitancy of Banking firms to adopt AIOps. Another problem is that many AIOps players are completely cloud-based and don’t support on-premises deployment which the banks require. GAVS’ proprietary AIOps platform, ZIFTM supports both on-premises and cloud implementation. ZIFTM also brings together data from multiple platforms under a single dashboard and addresses the problem of data fidelity usually faced by the banking ITOps team.

The financial institutions use numerous monitoring tools to monitor their IT Infrastructure but all those tools work in silos and the firms don’t get a unified view of all the data. The ITOps team is bombarded with a huge number of alerts and they miss out on important alerts as there is not enough information to prioritize the events. This increases the MTTR and leads to business losses. ZIFTM provides a full-stack monitoring capability where it monitors the entire IT infrastructure and provides a consolidated view of all the alerts and failures in a single place. The ZIFTM Monitoring framework is completely agentless. As no agents need to be deployed, the banking firms need not worry about security vulnerabilities and data breaches.

The correlation engine extensively uses unsupervised machine learning algorithms and correlates all the events and alerts and creates a single ticket for the root cause event. This reduces the chances of the ITOps team missing out on the important alerts due to alert fatigue. We know that many banks haven’t completely migrated from the legacy mainframe applications. The correlation engine of ZIFTM could be integrated with mainframe monitoring tools like ASG-Tmon, IntelliMagic vision and noise suppression of alerts could be done. The correlation module of ZIFTM is platform-agnostic and it can ingest data from any third-party tools which the banking firms use currently. The Universal connector tool in ZIFTM enables this integration. This tool is GUI-based, and integration could be done with ease even by the IT personnel who don’t have coding knowledge. The anomaly detection capability of the correlation engine can be leveraged to detect fraudulent transactions in minimal time.

The banks are nowadays very much concerned about the customer experience. As per a report, 74% of the bank operation leaders say that customer experience is their topmost strategic priority. To provide a seamless customer experience there shouldn’t be any disruption in banking services even for seconds. The Analytic and Predictive module of ZIFTM helps achieve this goal as it enables the ITOps team to be proactive instead of being reactive. The ZIFTM platform learns from historical data and predicts the events and potential failures at a minimum of 60 minutes in advance. They also suggest proactive remedial measures and notifies the appropriate Engineer of the upcoming failure.

The Automation capabilities of ZIFTM are also of great use to the banks. During festivals and other such occasions, there would be an abnormal spike in the number of transactions processed and resource utilization. The bank servers are often unable to handle the huge, unexpected load. The predictive modules in ZIFTM will be able to predict the resource utilization accurately and dynamically create VMs and provide additional storage as per the requirement. This will make life easy for banking institutions that generally face customer backlash for failed transactions during the festival seasons. The automation module of ZIFTM has about 250 pre-built workflows. New bots can be added as per the requirements of the bank. The Automation workflows to address the redundant Chargeback queries could be very helpful for the bank to reduce the number of fraud transactions and save the costs spent in dispute resolution for them. The Chatbot functionality is also available in ZIFTM which auto-triages tickets to the appropriate person and handles the mundane queries asked the customers.

More and more banking institutions are migrating from legacy mainframe, distributed systems to container-based, service-oriented architectures. The Implementation of AIOps will enable this transformation initiative to be hassle-free. This transformation will enable the banks to provide a safe, dependable, and consistent customer experience for their services which in turn improves Net Promoter Score (NPS) for banks and this positively influences their revenue generation and business outcomes.

ZIFTM also significantly helps in cost reduction. As the top-line revenues of the banks are challenged in today’s pandemic world and cost reduction has become mandatory across the BFSI sector, ZIFTM will very well serve that purpose by reducing the IT OPEX for banks.

Nithesh is a Lead Consultant at GAVS and is a part of the ZIF Product Marketing team. He is a product enthusiast and loves learning new technologies. Apart from work he is passionate about sports and loves exploring new places.

Please complete the form details and a customer success representative will reach out to you shortly to schedule the demo. Thanks for your interest in ZIF!